If you’re located in Richmond, Glen Allen, Short Pump, Midlothian, or Henrico County, your AC…

Understanding HVAC Tax Credits in 2025: What Homeowners & Contractors Need to Know

If you’re a homeowner in Glen Allen, Richmond, Short Pump, or anywhere across Central Virginia, upgrading to a more energy-efficient HVAC system has likely been on your radar — especially with rising utility costs and increased focus on sustainability.

But there’s something else driving the push for high-efficiency systems: federal tax credits.

Several of these HVAC-related tax incentives may be changing in the near future due to proposed legislation in Congress. Whether you’re planning to replace your old air conditioner or invest in a new heat pump, it’s worth understanding how these incentives work — and what could soon be at stake.

Key HVAC Tax Credits That Could Affect Your Next Upgrade

From residential upgrades to commercial retrofits, these tax credits have helped homeowners and contractors across Henrico County, Midlothian, and the greater Richmond area make smart, budget-friendly decisions when installing new HVAC systems.

Here’s a simple breakdown of what’s currently available:

🔹 25C – Energy Efficient Home Improvement Credit

What it is:

A federal tax credit for homeowners who install qualifying energy-efficient HVAC systems — including heat pumps, air conditioners, furnaces, boilers, insulation, and more.

Credit amount:

Covers 30% of the installed cost, with maximums like:

-

$600 for a new central air conditioner

-

Up to $2,000 for heat pumps

Why it matters:

If you’re upgrading your home’s comfort system in areas like Glen Allen or Short Pump, this credit helps lower your upfront investment. It’s a strong selling point for high-efficiency equipment, especially when combined with local rebates.

🔹 25D – Residential Clean Energy Credit

What it is:

This credit supports the use of renewable energy in your home — including geothermal heat pumps, solar panels, and solar water heaters.

Credit amount:

30% of the total cost, with no cap.

Why it matters:

If you’re exploring solar or geothermal HVAC solutions in Richmond or the surrounding counties, this incentive makes the transition to clean energy much more affordable.

🔹 179D – Commercial Buildings Energy Efficiency Deduction

What it is:

A tax deduction for building owners and contractors who install energy-efficient systems in commercial spaces — including lighting, HVAC, and insulation upgrades.

Deduction value:

Up to $5.00 per square foot depending on energy savings.

Why it matters:

If you manage or maintain churches, schools, or office buildings in Central Virginia, this credit can make commercial HVAC upgrades more cost-effective. Great for light commercial work across Glen Allen and Henrico County.

🔹 45L – Energy-Efficient Home Credit

What it is:

A tax credit for homebuilders or contractors constructing homes that meet ENERGY STAR® or DOE Zero Energy Ready standards.

Credit value:

Up to $5,000 per qualifying home.

Why it matters:

If you’re a contractor or developer in growing areas like Midlothian or Mechanicsville, incorporating energy-efficient HVAC systems into new construction can offer valuable tax savings.

🔹 Local Utility Rebates & State Incentives

In addition to federal tax credits, many local utilities — including Dominion Energy — offer rebates for installing ENERGY STAR-rated HVAC systems, smart thermostats, and upgrading ductwork or insulation.

How to use them:

Stack these rebates with federal tax credits to reduce the total cost of your HVAC upgrade. This approach often helps homeowners in Glen Allen and Richmond move forward with a more efficient system sooner.

Stay Ahead of the Curve

Proposed legislative changes could reduce or even eliminate some of these HVAC tax incentives in the coming months. If you’re thinking about upgrading your system, it’s a smart time to act. Not only could you lock in the current tax credits, but you’ll also enjoy lower energy bills and better year-round comfort.

Need help navigating your options?

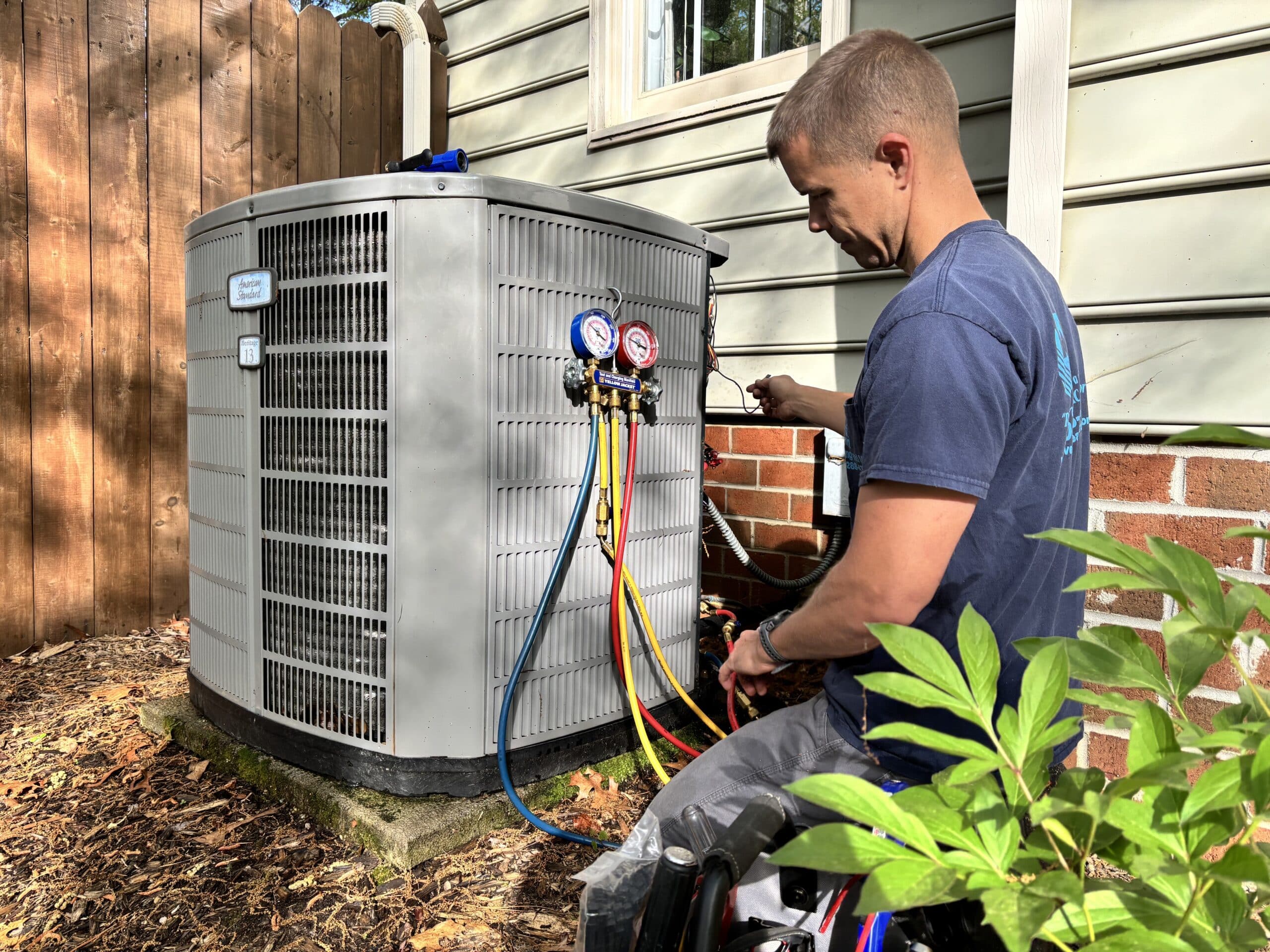

At West End Heating & Air, we help homeowners and businesses throughout Glen Allen, Short Pump, and the Richmond metro area make the most of available incentives. From high-efficiency installations to smart system upgrades, our team is here to guide you every step of the way.

Contact us today to schedule a consultation or get a quote for your next HVAC project.